RELATED

Kazakhstan’s Qarmet produced 3.8 million tons of steel in 20252026-02-10

Kazakhstan’s Qarmet produced 3.8 million tons of steel in 20252026-02-10 Steel exports from Turkey grew by 12.5% y/y in 20252026-02-03

Steel exports from Turkey grew by 12.5% y/y in 20252026-02-03 India’s JSW Steel increased steel production by 6% y/y in October-December2026-01-27

India’s JSW Steel increased steel production by 6% y/y in October-December2026-01-27 Reference prices for Brazilian slab in December were $485/t2026-01-20

Reference prices for Brazilian slab in December were $485/t2026-01-20 The US increased its imports of rolled steel products by 12.9% m/m in October2026-01-13

The US increased its imports of rolled steel products by 12.9% m/m in October2026-01-13

MESSAGE

In 2025, Ukraine’s iron and steel sector continues to operate under significant challenges due to the ongoing military situation and economic instability. As a result, key enterprises in the sector are demonstrating varying levels of production capacity utilization, reflecting both the impact of external factors and companies’ adaptation to new market realities.

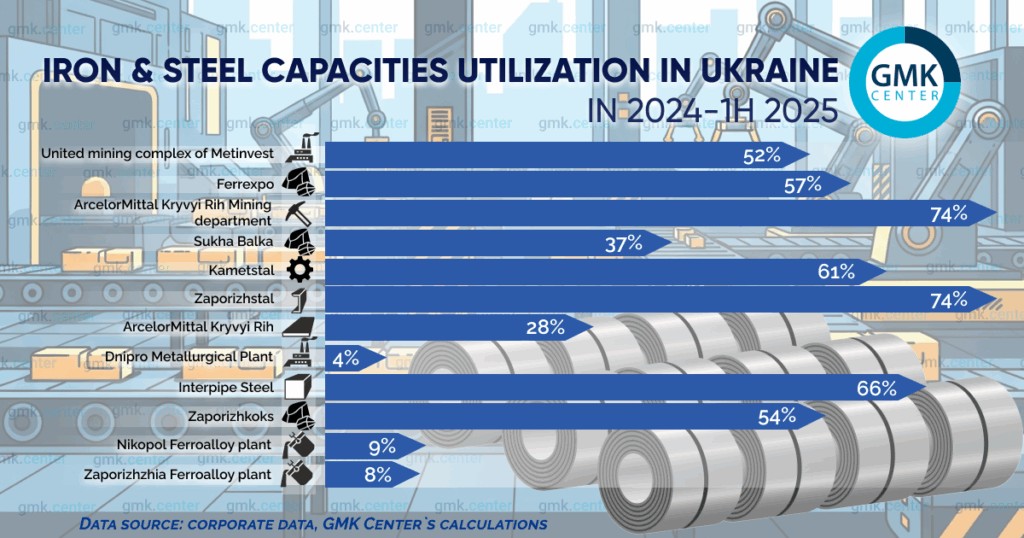

GMK Center assessed the level of capacity utilization across enterprises in different segments of the iron and steel complex based on production figures for 2024 and the first six months of the current year.

Mining and Processing Plants

As of the end of 2024, Ukraine’s mining and processing plants operated at different capacity levels depending on the company. Enterprises of the Metinvest Group – Northern and Central Mining and processing Plants (GZK) – reached nearly 100% capacity, while Southern and Ingulets Mining and processing Plants have been idled for an extended period due to weak profitability and pressure from several internal factors. According to GMK Center estimates, the average utilization rate at Metinvest’s combined mining assets in 2024 and the first half of 2025 stood at 52%.

The Poltava Mining and Beneficiation Plant of the Ferrexpo Group suspended two out of its three pellet production lines in May of the current year due to the lack of VAT refunds for exported products. Without VAT refunds, Ferrexpo planned to reduce production volumes to 25% of full capacity, but the company is currently maintaining a fairly high utilization rate – 57% as of the results of last and the first half of the current year.

The mining division of ArcelorMittal Kryvyi Rih operated at 74% last year, while Sukha Balka of the DCH Group ran at about 37% capacity. Meanwhile, the Kryvyi Rih Iron Ore Plant (KZRK) has been idle since March 2025 due to the absence of sales markets and demand for its products, as well as withheld VAT refunds.

Steel plants

The overall capacity utilization rate of steel enterprises for the first half of the current year was about 45% (with the 2024 result at 46%). However, the performance of individual plants varies significantly depending on their financial and economic circumstances and on the market situation.

For instance, the average utilization rate at Kametstal in 2024 and the first half of 2025 was 61%, at Zaporizhstal – 74%. For its part, the Interpipe Steel plant, according to estimates by GMK Center, averaged a utilization rate of 65.6% during the same period.

Last year, ArcelorMittal Kryvyi Rih operated at 27.5% of its crude steel production capacity. Dnipro Metallurgical Plant (DMZ) is operating only its rolling capacities at minimal utilization levels, based on available orders. According to GMK Center estimates, DMZ’s utilization does not exceed 4%.

Ferroalloy Plants

The state of the ferroalloy sector deteriorated significantly after the onset of the full-scale invasion. At the end of 2023, the key producers – Zaporizhzhia Ferroalloy Plant and Nikopol Ferroalloy Plant – suspended production due to high electricity prices and proximity to the front line. Since the second quarter of 2024, the plants have resumed operations and have gradually ramped up output. As a result, last year the capacity utilization of ferroalloy enterprises was extremely low, not exceeding 8–9%, although it has somewhat increased in 2025.

The mining and processing plants – Pokrovsk and Marhanets – are currently not engaged in mining operations, although the agglomeration plants can process raw materials in minor quantities.

Coking plants

Zaporizhkoks is currently operating at approximately 54% of capacity, while Dnipro Metallurgical Plant (DMZ) has decided on the complete shutdown of coke production.

Reasons for low capacity utilization

The following general factors significantly affect production loading levels and, overall, the way mining and metallurgical enterprises conduct business:

- high security risks;

- continuous increases in energy resource prices and tariffs (electricity, gas);

- high logistics tariffs;

- significant personnel shortages;

- global trade wars, which negatively impact external demand, among others.

Against this backdrop, there are no substantial growth drivers for the Ukrainian economy, and government decisions on stimulating economic activity have almost no positive effect on the level of production capacity utilization in the iron and steel sector.

Please give us a message