Who we are

RELATED

Kazakhstan’s Qarmet produced 3.8 million tons of steel in 20252026-02-10

Kazakhstan’s Qarmet produced 3.8 million tons of steel in 20252026-02-10 Steel exports from Turkey grew by 12.5% y/y in 20252026-02-03

Steel exports from Turkey grew by 12.5% y/y in 20252026-02-03 India’s JSW Steel increased steel production by 6% y/y in October-December2026-01-27

India’s JSW Steel increased steel production by 6% y/y in October-December2026-01-27 Reference prices for Brazilian slab in December were $485/t2026-01-20

Reference prices for Brazilian slab in December were $485/t2026-01-20 The US increased its imports of rolled steel products by 12.9% m/m in October2026-01-13

The US increased its imports of rolled steel products by 12.9% m/m in October2026-01-13

MESSAGE

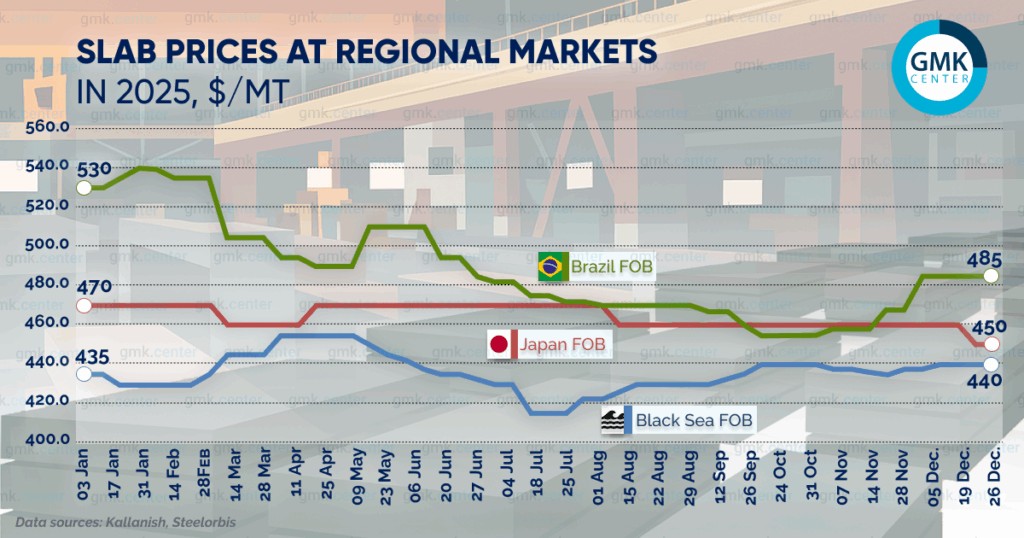

Regional slab markets saw mixed price trends in December. According to SteelOrbis, the reference export price for Brazilian slab remained unchanged in December at $485/t (FOB), which is a six-month local high.

According to Kallanish, Brazilian mills increased their production of semi-finished products in November last year by 7.4% compared to October, to 856,000 tons, of which 798,000 tons were slabs. Semi-finished product output for the 11 months decreased by 7.6% y-o-y to 7.8 million tons. Slab exports for the past year amounted to 6.8 million tons at an average price of $524/ton, which is 24% more than in 2024. In December last year, the figure increased by 19% to 762 thousand tons.

After the launch of the European CBAM on January 1, Brazilian slab producers have seen great opportunities open up. Their products are much more attractive to European buyers due to their low carbon content and lower CBAM payments compared to producers from other countries. The estimated CBAM costs per ton of Brazilian slab are €30/t, while for products from Vietnam and China they are €100/t and €173/t, respectively.

As of the end of 2025, Brazil had nearly 6.4 million tons of excess slab production capacity, which will enable local producers to significantly increase slab supplies to European rollers and expand their market share in Europe (8% in 2025).

Price dynamics varied in other regional markets. Average slab prices in Japan fell by $10 to $450/t in December. Average FOB Black Sea quotations remained stable at $440/t last month, slightly higher than at the end of November ($438/t).

The situation on the slab market in Turkey is dynamic. In November, domestic slab production in the country increased by 11.1% y/y – to 1.22 million tons. Over the 11 months of last year, output decreased by 3% y/y – to 12.6 million tons.

Imports of products increased sharply after several months of decline. According to the Turkish Statistical Institute (TUIK), imports of slabs to Turkey in November increased by 60% compared to October and reached 382 thousand tons after a 28% decline in October. The growth was due to shipments from Brazil (106,000 tons). In the first 11 months of 2025, imports amounted to 3.6 million tons (-0.2% y/y), and their value decreased by 10.3% y/y – to $1.7 billion.

The average price of slab imports to Turkey in November was $464/t, compared to $467/t in October. The price difference between the largest suppliers was quite significant: Russia supplied slabs at an average price of $452/t, while Brazil (28% of the volume supplied in November) supplied them at $482/t.

In terms of price benchmarks, the average benchmark price for slabs – hot-rolled coil (HRC) – remained at $470/t (China FOB) in December, although there was a short-term increase of $5 at the beginning of the month.

As a reminder, at the end of November 2025, regional markets saw mixed trends in slab prices. The reference export price for Brazilian slabs rose significantly in November (by $27/t), reaching a local high for five months – $485/t (FOB).

Please give us a message